We invest in companies with solid business models in challenging situations in market, commercial, operational or governance.

We lever on our ample experience of transformation processes, combined with management’s know-how about the industry landscape and company to craft a strategic plan.

Through intensive work and joint effort, we develop solid pillars in our investments, paving the way for sustained growth and success in the long term.

Pinter provides painting services to industrial clients who outsource the process.

Established in 1978, Pinter grew steadily to become #1 in Catalonia, with a healthy revenue and EBITDA level and a team of approx. 100 employees.

Endurance alongside a co-investor provided a solution to its founder, allowing him to monetize the value generated during decades through a tailor-made acquisition and taking on the challenge to execute a smooth management transition.

Pinter’s owner maintained an institutional role to continue developing Pinter’s value, recognizing his dedication throughout the years.

A fragmented market – many small players – allowed for a build-up on the first year after the acquisition, by acquiring a competitor’s productive unit in the courts – rebranded Pintergran.

Distribuidora Joan distributes and commercializes equipment, cleaning and maintenance products to clients in industries including food, hospitality, public administration, hospitals, laboratories, industrial and other small distributors.

Its product portfolio includes more than 6.000 references in waste management equipment, cleaning and safety products, chemicals, cellulose products, food service equipment, disposable products and material handling equipment from renowned brands such as Rubbermaid, Proquimia, Spontex, 3M Kimberly Clark, Sutter or Vileda, among others.

Endurance provided a solution by designing a tailor-made acquisition and taking on the challenge to execute a smooth management transition.

Qualque manufactures cellulose products such as paper napkins and hygiene paper for hospitality and industry sectors.

Its product portfolio includes paper-made products such as napkins, tablecloths, toilet paper, hand drying paper and refreshing wipes, among others.

Endurance provided a solution by designing a tailor-made acquisition and taking on the challenges of operational restructuring and management transition execution.

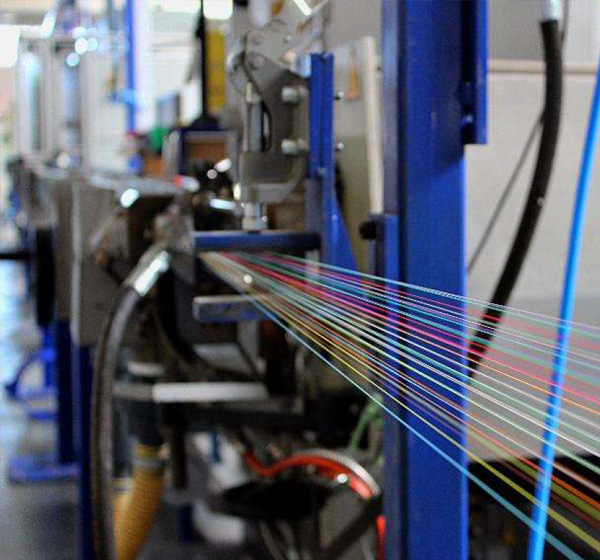

Telnet produces fiber optic cables (FO cables) and passive optical components (POC) with clients such as the main operators in the country, Telefónica, Orange or Vodafone, among others, and industrial companies such as Iberdrola, REE, or Renfe / Adif, among others, with more than 40 % of sales internationally.

The company, founded in 1996, expanded for decades in various business lines, in addition to FO Cables and POC, such as the development and manufacturing of 5G antennas and GPON equipment. These areas required a relevant R&D investment that was financed with debt. However, when the demand did not grow as expected, as a consequence of a slowdown in the deployment by operators resulting from the Covid-19 pandemic and macro instability in the context of the war in Ukraine, among other factors, the debt burden was impossible to assume leading the company to an unavoidable transformation process.

Endurance’s corporate transaction has enabled the company to clean up the company’s balance sheet completely and provide the financial and operational resources to continue its growth path focusing on fiber optic lines and passive optical components in relevant FO markets in Europe.

Alco rents equipment and machinery for construction and industry and designs/ builds temporary and permanent pre-fabricated modules from four operating bases in Spain, Chile and Colombia.

The company was established in 1964 and grew organically and inorganically (build-up of 5 companies together with a renowned national private equity fund), reaching a turnover of c. €87M and EBITDA of c. €28M in 2007.

The financial crisis and a 95% contraction of the company’s market triggered an operating deterioration that ultimately made the debt burden unassumable. Upon Endurance’s investment, Alco cleaned up its balance sheet completely and reversed a long trend of operational deterioration, with a positive result since its acquisition and with significant growth, based on its wide portfolio of machinery, scaffolding, platforms and modules, and its base of more than 4,000 clients.

Oro Vivo, established in 1989 by a group of local entrepreneurs with ample experience in the jewellery market, is a pioneering company in the jewellery retail sector in Spain and Portugal. OV markets own products and third party branded products, in its retail network of more than 60 points of sale in Spain and Portugal and the online shop.

This network is composed of shops located in exceptional locations in the main commercial centres in Spain and Portugal, including the Canary islands and Madeira.

Endurance’s investment allowed Oro Vivo to avoid liquidation in the context of article 5.bis of LC 38/2011, only some weeks after the beginning of the negotiations, providing the necessary funds and restructuring the debt in the face of the imminent Christmas campaign.

tuc tuc, established in 1995, designs and markets children’s clothing and childcare products, with a special focus on the 0-3 year old segment (+ 85% sales), whilst Canada House (“CH”) designs and markets children’s clothing with a special focus in the 3-16 year old segment (+ 70% sales).

Product complementarity gave rise to a project to materialize commercial and operational synergies with the merger of both companies in 2017.

The resulting company, based in Lardero (La Rioja) and Mataró (Barcelona), and combined revenue of c.€40M, has (i) more than 4.000 multibrand points-of-sale in more than 45 countries around the world, with special contribution from Italy, Dubai and Canada; (ii) 110 monobrand stores in Spain, Portugal and France and (iii) dedicated online shops in Spain, Portugal, France, Italy and UK (representing c.10% of total revenue).

TCN, established in 1986, designs and markets women’s apparel with special prominence in the swimwear and intimates segments through (i) monobrand shops in Spain, (ii) multibrand points of sale (nationally and internationally) and (iii) a rapidly growing e-shop since its launch. TCN has an affordable luxury approach, with presence in main catwalks, and average ticket of +€250 and gross margin +75%.

TCN’s business model focuses in exclusive designs, quality and control in the supply chain and close interaction with clients, closely managed by a top-notch team through state of the art processes and data analysis.